Illinois is dwelling to one of many worst pension crises within the nation.1 At 39% funded, in response to the nonpartisan Pew Charitable Trusts, Illinois has the worst pension funding ratio of any state.2 Against this, neighboring Wisconsin’s pension system is 103% funded.3 In fiscal 12 months 2022, Illinois’ complete general funds pension prices, including pension bond debt service, will devour $10.5 billion. That’s greater than 25% of the state’s normal revenues,4 and is only a fraction of the practically $130 billion in complete unfunded liabilities the state pension programs maintain.5

Makes an attempt to maintain up with this unsustainable debt burden with out reform have already pulled cash away from increased schooling, public security, public well being packages, and important providers for the poor and weak. Since fiscal 12 months 2000, a 584% enhance in inflation-adjusted pension spending was accompanied by a 20% minimize in spending on a variety of core providers.6

Why is Illinois on this place? There’s loads of blame to go round, however former speaker of the Illinois Home, Michael Madigan, now indicted on federal corruption prices, was a serious participant in main the state down this path.

Throughout his tenure, Madigan voted for each main invoice that will enhance Illinois’ pension liabilities. In 1989, Madigan was a Home sponsor for Senate Invoice 95, which handed with out an actuarial price estimate. The invoice was the beginning of three% compounding profit will increase for retirees in Illinois’ pension programs. In contrast to a real cost-of-living adjustment, these assured will increase should not tied to the overall worth stage or inflation.

So as to add to that, critics will level to the notorious 1994 “Edgar ramp,” former Gov. Jim Edgar’s plan to backload taxpayer contributions to state pensions so that they find yourself skyrocketing towards the top of the cost plans.7 However none of those numerous items of laws are the supply of Illinois’ pension woes. That distinction goes to the 1970 Constitutional Conference and the creation of the state’s pension clause, and the Illinois’ Supreme Courtroom’s inaccurate interpretations of that clause.

Earlier than he was even elected to the Illinois Home, voters selected Madigan as one of many delegates to the 1970 Illinois Constitutional Conference. That conference was the place Illinois’ pension disaster was born. Regardless of warnings in opposition to passing the modification that will handcuff future lawmakers and stymie future reform, a majority of the conference, together with Michael Madigan, voted to incorporate the supply within the new state structure.

Illinois is an outlier regarding pensions

Contents

In 1970, Illinois held a conference to undertake a brand new structure for the state. One of many provisions adopted was Article XIII, Part 5: the pension safety clause. That part reads:

“Membership in any pension or retirement system of the State, any unit of native authorities or faculty district, or any company or instrumentality thereof, shall be an enforceable contractual relationship, the advantages of which shall not be diminished or impaired.”

This part of legislation, which can on its face appear unremarkable, has been the supply of Illinois’ pension woes. Due to it, Illinois has a number of the most restrictive provisions for reforming pensions within the 50 states. It’s one in all solely eight states that enshrine public pension advantages in its structure.8 And Illinois is one in all solely 11 states that defend future accruals for all individuals.9 That is largely due to how the Illinois Supreme Courtroom has interpreted the legislation.

The state’s courts have reliably struck down practically all10 proposed reforms to Illinois’ pension system, even modest reforms that will not contact present advantages. These rulings make Illinois an outlier amongst different states in current pension litigation. Based on a forthcoming article by T. Leigh Anenson and Jennifer Ok. Gershberg within the “Notre Dame Journal of Regulation, Ethics, and Public Coverage” that surveyed litigation difficult state pension modifications from 2014 to 2019, courts have just lately been favorable to reform.11 The authors discovered a majority of pension reforms have withstood authorized challenges, together with in eight of 12 courtroom choices on cost-of-living changes (COLAs) in that point interval.12

COLAs have been one of many best contributing components to Illinois’ pension disaster. Tier 1 pensioners obtain an annual COLA that compounds at 3% yearly, and simply this annual enhance makes up a big portion of the state’s liabilities.13 In 2013 the Common Meeting handed a pension reform plan that will have addressed the issue by pegging these COLAs to inflation as a substitute of imposing a static 3% annual enhance.14 However this plan was struck down by the state supreme courtroom as violating the pension clause, stating that “[a]lthough the police powers of the legislature are broad and far-reaching, our case legislation makes clear that their train should not battle with the structure. If the structure mandates that one thing be executed or not executed, the legislature could not depend on its police powers to violate that mandate or override specific constitutional ensures.”15 This led the courtroom to the conclusion that “the annuity discount provisions of Public Act 98-599 enacted by the legislature and signed into legislation by the Governor violate article XIII, part 5’s specific prohibition in opposition to the diminishment of the advantages of membership in public retirement programs.”16

With that and different makes an attempt to make native authorities employee pensions extra fiscally sustainable forestalled by Illinois courts,17 the one choice left is a constitutional modification to allow the state to align public pensions with the state’s fiscal actuality.

An modification to the Illinois Structure can enable for wanted reforms with out operating afoul of the U.S. Structure

The Illinois Supreme Courtroom’s interpretation of the pension clause leaves the state with one actual choice: a constitutional modification. An modification that permits the state to switch future advantages whereas defending advantages that pensioners have already earned can be sufficient to place Illinois on a path to solvency, because the Illinois Coverage Institute has demonstrated.18 Such an modification to the state structure ought to foreclose the potential of a profitable authorized problem beneath state legislation. However what about federal legislation?

Gov. J.B. Pritzker has dismissed the concept a constitutional modification can reform pensions, citing the Contracts Clause of the U.S. Structure.19 That clause reads:

“No State shall… move any Invoice of Attainder, ex publish facto Regulation, or Regulation impairing the Obligation of Contracts…”20

The argument is that pension advantages, together with COLAs and the speed of progress in advantages, are a part of a longtime contract the state authorities could not violate. This argument ignores the quite a few instances the place states have efficiently modified contracts for a big and legit public goal, together with pensions, with out being barred by the federal Contracts Clause. The Contracts Clause is just not an absolute bar to modifying contracts.21 There’s a three-part take a look at to find out if a modification equivalent to pension reform is permitted.22

First, the courtroom should set up {that a} contract exists.23 As mentioned above, Illinois courts have acknowledged each previous and future advantages, together with COLAs, as a part of the state’s contract with pensioners. However federal courts, whereas they typically defer to state interpretation in answering this query,24 apply federal, not state legislation to the evaluation.25 Which means it’s doable a federal courtroom could not even acknowledge future advantages, such because the COLA, as a part of the contract. States can not increase what is taken into account a contract by federal legislation just by calling one thing a contract. A evaluation of Supreme Courtroom case legislation by Columbia College Regulation Professor Henry Paul Monaghan26 suggests “a state courtroom can not enlarge the vary of pursuits embraced by the Contract[s] Clause just by recognizing an association as a ‘contract’ as a matter of state substantive legislation.”27 One other journal article by College of Minnesota Affiliate Professor Amy Monahan concluded charges of future accrual, as potential adjustments to a contract, “shouldn’t be thought-about unconstitutional impairments.”28 Nevertheless, that article as of the time of its publication in 2012 had not recognized a federal case the place the courtroom dominated “in direct opposition to a state courtroom’s discovering {that a} contract existed beneath federal legislation.”29 Quite the opposite, there are a number of examples of federal courts explicitly deferring to state legislation on the query of what constitutes the contract.30 Due to this fact, it’s nonetheless extra seemingly a federal courtroom will defer to the Illinois Supreme Courtroom’s interpretation, recognizing future advantages as a part of the contract being impaired beneath a Contracts Clause evaluation.

If the courtroom finds a contract exists, it should then discover if there’s a substantial impairment, i.e. that “the fitting abridged was one which induced the events to contract within the first place,” or “the impaired proper was one on which there had been cheap and especial reliance.”31 However even when a courtroom discovered the reform to be an impairment of a contractual relationship, if the coverage have been “cheap and essential to serve an vital public goal,” the reform would nonetheless be upheld.32 Courts will give much less deference to a state’s impairment concerning what’s “substantial” if the state is a celebration to the contract, as can be the case with Illinois public pensions.33

The foundational case on public goal precept was determined within the Nice Melancholy in Residence Constructing & Mortgage Affiliation v. Blaisdell.34 Minnesota handed a legislation extending the time for mortgagers to redeem their mortgages from foreclosures. That legislation was challenged as an impairment of contracts, however the U.S. Supreme Courtroom upheld the statute as a result of the state of affairs of the Nice Melancholy justified the measures taken, Contracts Clause however.

However this limitation to the Contracts Clause doesn’t solely apply in emergency conditions. The Supreme Courtroom has additionally given “remedying of a broad and normal social or financial downside” for instance of a professional public goal that may survive a Contracts Clause problem.35 In that case, the problem was the modification of utilities costs in Kansas. It’s actually debatable that the pension prices which are plaguing Illinois are a minimum of as vital a public goal.

However the precise coverage should be “’clearly crucial’ or ‘important,’ not merely handy or expedient.”36 For instance, the Seventh Circuit Courtroom of Appeals has dominated eradicating employment protections for a instructor already tenured is just not cheap and crucial for the aim of bettering public schooling. If the state may obtain the objective by way of a much less drastic modification, then the impairment will violate the Contracts Clause.37

In Illinois’ case, opponents of pension reform could argue the state may at all times elevate extra taxes or minimize providers to fund pensions and so any modification can be pointless. However a call from the Fourth Circuit Courtroom of Appeals has additionally decided the actual fact a state may have raised taxes or may have shifted funds from different packages to meet their contracts is just not sufficient for an impairment to violate the Contracts Clause.38 Such a requirement would imply no impairment of a authorities contract may ever be constitutional. As an alternative, the courtroom reasoned it should solely stop states from contemplating “impairing the obligations of [their] personal contracts on a par with different coverage options,” from imposing “a drastic impairment when an evident and extra reasonable course would serve its functions equally properly,” or from performing “unreasonably in gentle of the encircling circumstances.”39

Pension reform in Illinois ought to move all these checks. The Illinois Coverage Institute has advocated a reform that will set the state’s pension programs on observe to solvency by way of modest adjustments changing the Tier 1, 3% compounding post-retirement will increase with a measure pegged to inflation and capping the utmost pensionable wage for employees employed earlier than 2011. This reform would solely apply to future advantages, and no pensioner would obtain a single discount of their profit test. That easy modification would save the state $2 billion yearly and can be a lot much less drastic than decreasing present advantages or changing the outlined profit system to an outlined contribution plan.40 Extra importantly, making an attempt to tax and minimize providers out of this case is virtually infeasible. Based on calculations made in 2018 by J.P. Morgan chair of market and funding technique Michael Cembalest,41 Illinois would wish to spend 51% of the state finances on pensions and different post-employment advantages to remove the debt with out reform, or elevate revenue taxes by 25% to remove the debt. A 2016 Brookings Institute paper lays out the choices: hope for good funding returns, elevate taxes, minimize spending, or enhance worker contributions.42

None of those choices are realistically obtainable for Illinois. Illinois pensions already use unrealistic return assumptions of their calculations43 and must obtain even bigger, constant 11.5% returns44 to shut the hole. Pension funds such because the Lecturers Retirement Fund are already closely invested in different belongings in hopes of assembly their obligations – as of 2021 TRS is over 40% invested in different funding belongings45, which have a tendency to hold extra danger.46 Furthermore, a recession just like the one seen in 2008 may wipe out any of the positive aspects pensioners are relying on.

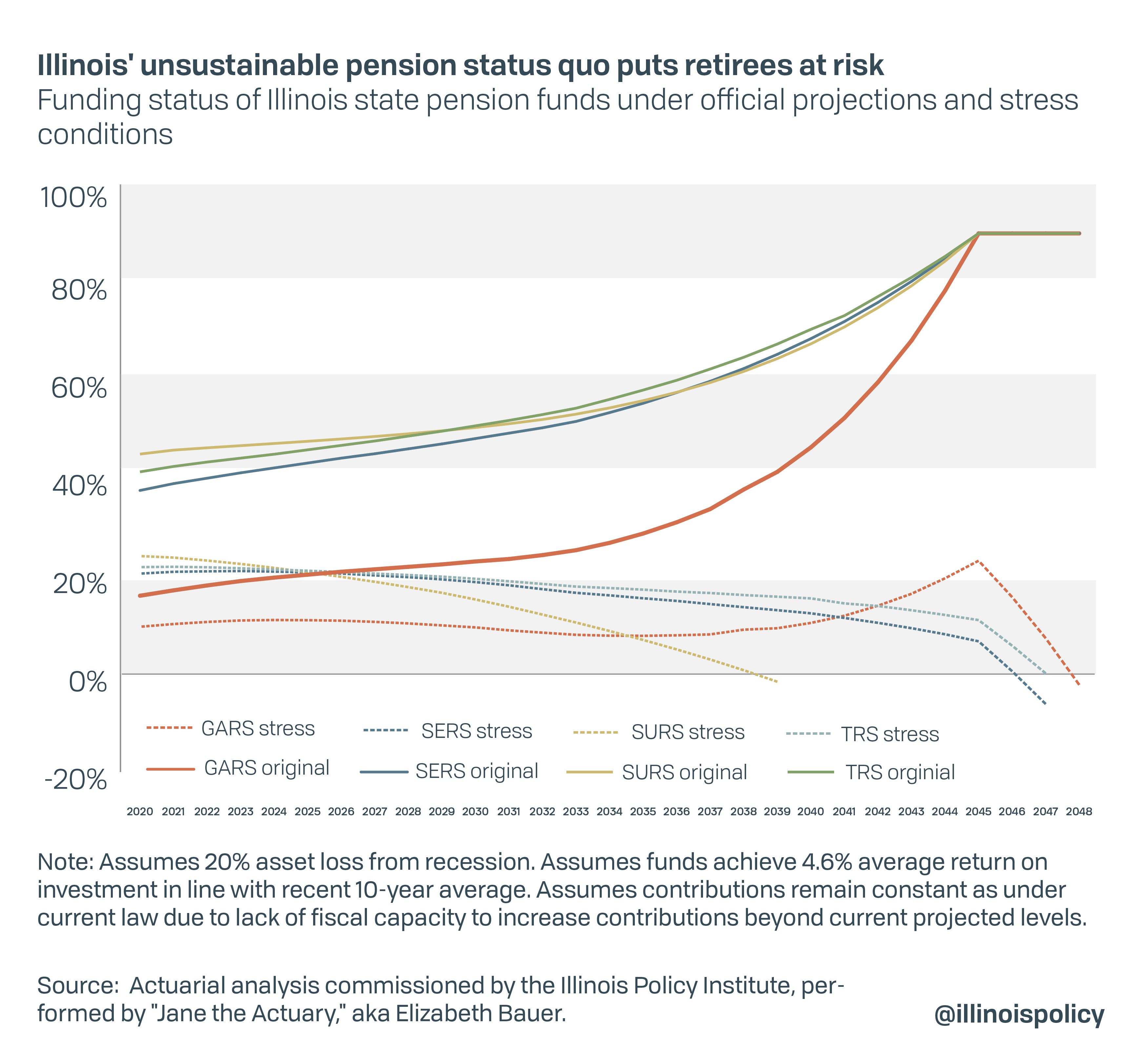

That risk is just not mere hypothesis. The Illinois Coverage Institute commissioned an actuarial stress take a look at of the 4 largest Illinois statewide pension funds and located if funds have been to lose 20% of their asset worth because of a recession – the identical loss skilled in 2009 – and the next common return on funding matches the roughly 4.6% the funds skilled within the 10 years after the top of the final recession, the state’s main retirement programs would run out of cash in fewer than 30 years.

Rising taxes is unfeasible. The state already has one of many highest tax charges within the nation47 and must elevate revenue taxes a minimum of 25% and dedicate all new income solely to elevated pension funds. In 2018, Pritzker pushed passage of the so-called “Honest Tax” to permit the state to implement a progressive revenue tax, which Pritzker pitched as an answer to Illinois’ fiscal issues, together with its public pension debt.48 The modification to the structure was handed by the Common Meeting and submitted to the voters for approval. However these voters overwhelmingly rejected the modification.49 And even when it had handed, and Pritzker’s desired tax charges have been adopted, Illinois’ monetary issues wouldn’t be solved. In some methods, the state of affairs would have been worse. Financial evaluation from the Illinois Coverage Institute estimated the tax plan would have price Illinois as much as 95,000 jobs and $18 billion in financial exercise.50

Borrowing cash – itself a promise of future taxes – to cowl pension prices is just not a practical resolution, both. Regardless of its current credit score improve, Illinois nonetheless has the worst credit standing of any state, making its borrowing prices that a lot higher as properly.51 The state may pray for a federal bailout to pay for pensions, however Illinois only in the near past acquired federal funds in response to the COVID-19 pandemic and the accompanying shutdown of companies, elevated prices and predicted drop in revenues.52 One other inflow of federal money for the state’s self-inflicted pension woes appears unlikely.

Chopping state spending to reallocate to pensions is just not a practical choice, both. Pensions already take up greater than 1 / 4 of Illinois’ finances and a higher share of its income than every other state.53 Extra concretely, pension funds are already crowding out important providers, and residents are feeling the ache.54 Chopping extra to pay for pension debt would solely additional hinder the state’s capability to serve the general public.

The one remaining choice is growing worker contributions, and, setting apart whether or not the pension safety clause would allow such a rise in worker contributions, these contributions must skyrocket by nearly 700% – sometimes greater than 60-70% of an worker’s wage – to make up the distinction.55 The Contracts Clause mustn’t require the state to take such drastic measures earlier than modifications are allowed.

In reality, pension reform has survived state contracts clause claims most of the time in current instances, as illustrated within the Anenson article. In 36 of 45 instances, pension reforms challenged beneath the Contracts Clause have been upheld.56 Against this, solely 2 of 9 reforms challenged beneath a state’s pension clause have been upheld.57

Pensioners themselves mustn’t need reform to fail, both. Whereas the structure prevents the state from diminishing advantages, it most definitely doesn’t require appropriations to pension funds. In reality, Illinois legislation makes this specific.58 And if the pension programs run out of funds, then there might be no cash to pay advantages and it’s unlikely pensioners would have any treatment obtainable to them.59

If that occurs, pensioners would merely be out of luck. But when the system is reformed to be self-sustaining, then retirees can know their retirement advantages are secure.

Conclusion

Pension reform is crucial to fixing Illinois’ finances issues and offering primary providers to its residents. Illinois’ restrictions on pension modification stop that wanted reform and make Illinois an outlier among the many remainder of the nation with regards to cheap pension modification. The one actual resolution obtainable to the state is to amend its structure to permit for these wanted reforms. Politicians have pointed to the federal Contracts Clause as an excuse to dismiss any such modification, however the Contracts Clause permits for modifications which are cheap and essential to attaining a better public goal. There are many causes to imagine modest pension reform will move that take a look at, as has been the case in states equivalent to Rhode Island. And with the present state of Illinois’ funds, the state can not afford to not attempt.

Endnotes

1Adam Schuster, “Moody’s report: Illinois pension debt reaches document excessive $317 billion,” Illinois Coverage Institute, March 5, 2021.

2“The State Pension Funding Hole: Plans Have Stabilized in Wake of Pandemic,” Pew Analysis Middle, Sept. 14, 2021.

3Id.

4Adam Schuster, “Tax hikes fail to steadiness Illinois finances, however lawmakers elevate personal pay,” Illinois Coverage Institute, June 3, 2021.

5“Particular Pension Briefing,” Fee on Authorities Forecasting and Accountability, Nov. 15, 2021.

6Adam Schuster, “Illinois Ahead 2023: Solely Pension, Price range Reform Can Save Taxpayers When Federal Assist Ends,” Illinois Coverage Institute (Spring 2022).

7Ted Dabrowski, “The Edgar Ramp – the ‘reform’ that unleashed the Illinois pension disaster,” Illinois Coverage Institute, Oct. 27, 2015.

8Alaska Const. Artwork. 12, §7; Ariz. Const. Artwork. 29, §1D; Haw. Const. Artwork. 16, §2; In poor health. Const. Artwork. 13, §5; La. Const. Artwork. 10, §29(A) and (B); Mich. Const. Artwork. 9, §24; N.M. Const. Artwork. 20, §22(A); N.Y., Artwork. 5, §7(a); See additionally “Authorized protections for state pension and retiree well being advantages,” Pew Analysis Middle, Could 30, 2019.

9“Authorized protections for state pension and retiree well being advantages,” Pew Analysis Middle.

10See Heaton v. Quinn (In re Pension Reform Litigation), 2015 IL 118585; Jones v. Municipal Staff’ Annuity & Profit Fund, 2016 IL 119618; Piccioli v. Board of Trustees of the Lecturers’ Retirement System, 2019 IL 122905.

11T. Leigh Anenson and Jennifer Ok. Gershberg, The Authorized and Moral Implications of Public Pension Reform: Analyzing the New Constitutional Instances, 36 Notre Dame Journal of Ethics and Public Coverage, 117 (2022).

12Id. at 55 (citing to state and federal instances from Rhode Island, Kentucky, Maine, Tennessee, New Hampshire, New Jersey, Washington and Texas.)

13Schuster, “Illinois Ahead 2023.”

14In poor health. Pub. Act 098-0599.

15In re Pension Reform Litigation, 2015 IL 118585.

16Id.

17See e.g., Adam Schuster, “Chicago Park District pension reform dominated unconstitutional,” Illinois Coverage Institute, April 5, 2018; Ted Dabrowski, “Chicago pension reform dominated unconstitutional,” Illinois Coverage Institute, July 24, 2015.

18Schuster, “Illinois Ahead 2023.”

19“Learn Gov. Pritzker’s state finances tackle,” Chicago Tribune, Feb. 19, 2020.

20U.S. Const. Artwork. 1, §10, cl. 1.

21Amy Monahan, Public Pension Plan Reform: The Authorized Framework, 10-13 College of Minnesota Regulation College Authorized Research Analysis Paper Sequence 6 (2010) (citing United States Belief Co. v. New Jersey, 431 U.S. 1, 21 (1977)).

22Id. at 17-25

23Id. at 17-18.

24Amy B. Monahan, Statutes as Contracts? The “California Rule” and its Impression on Public Pension Reform, 1029 Iowa Regulation Revue 97 (2011).

25Irving Belief Co. v. Day, 314 U.S. 556, 561 (1942) (“When this Courtroom is requested to invalidate a state statute upon the bottom that it impairs the duty of a contract, the existence of the contract and the character and extent of its obligation develop into federal questions for the needs of figuring out whether or not they’re inside the scope and that means of the Federal Structure, and for such functions finality can’t be accorded to the views of a state courtroom.”).

26Henry Paul Monaghan, Supreme Courtroom Evaluation of State Courtroom Determinations of State Regulation in Constitutional Instances 103 Columbia Regulation Revue 1919, 1937-1940 (2003) (citing Common Motors Corp. v. Romein 503 U.S. 181 (1992), Trs. of Dartmouth Coll. v. Woodward, 17 U.S. (4 Wheat.) 518 (1819), Garrison v. Metropolis of New York, 88 U.S. (21 Wall.) 196 (1874)).

27Id. at 1940, n. 82.

28Amy B. Monahan, Statutes as Contracts? at 1033; See additionally id. at 1042 and 1046; See additionally Whitney Cloud, State Pension Deficits, the Recession, and a Fashionable View of the Contracts Clause, 120 Yale Regulation Journal 2199, 2203 (2011) (“Typically, solely retroactive modifications affecting already vested rights violate the Contracts Clause.”).

29Monahan, Statutes as Contracts? at 1045.

30See T. Leigh Anenson, Linda L. Barkacs, and Jennifer Ok. Gershberg, Article: Constitutional Limits on Public Pension Reform: New Instructions in Regulation and Authorized Reasoning, 15 Virginia Regulation and Enterprise Evaluation 337, 371 (2021) (“However reliance on federal legislation in regards to the existence of a contract remains to be stunning as a result of the Supreme Courtroom has repeatedly declared that it’ll defer to state legislation on that challenge (albeit affirming that federal legislation finally solutions the query).”); see additionally, e.g., Me. Ass’n of Retirees v. Bd. Of Trs. Of the Me. Pub. Emps. Ret. Sys., 758 F.3d 23, 29 (1st Cir. 2014);

Common Motors Corp. v. Romein, 503 U.S. 181, 187 (1992) (federal courts “accord respectful consideration and nice weight to the views of the State’s highest courtroom.”).

31Baltimore Lecturers Union v. Mayor of Baltimore, 6 F.3d 1012, 1017 (4th Cir. 1993)

32Parker v. Wakelin, 123 F.3d 1 (1st Cir. 1997) (citing United States Belief Co., 431 U.S., 25-26).

33Id. at 5; See additionally Paul M. Secunda, Constitutional Contracts Clause Challenges in Public Pension Litigation, 28 Hofstra Labor ands Employment Regulation Journal 263, 284 (2010) (citing Parella v. Ret. Bd. of R.I. Emps. Ret. Sys., 173 F.3d 46, 59 (1st Cir. 1999)).

34Residence Constructing & Mortgage Asso. v. Blaisdell, 290 U.S. 398 (1934)

35Vitality Reserves Group v. Kansas Energy & Mild Co., 459 U.S. 400, 412 (1983) (citing Allied Structural Metal Co., 438 U.S., at 247, 249).

36Elliott v. Board of Sch. Trustees of Madison Consolidated Faculties, 876 F.3d 926, 938 (seventh Cir. 2017) (citing El Paso v. Simmons, 379 U.S. 497, 516 (1965)).

37Id.

38Baltimore Lecturers Union v. Mayor of Baltimore, 6 F.3d at 1019-1020.

39Id. at 1020 (citing United States Belief, 431 U.S. at 30-31).

40Adam Schuster, “Illinois Ahead 2022.”

41Michael Cembalest, “The ARC and the Covenants 4.0,” J.P. Morgan Non-public Financial institution, Oct. 9, 2018.

42Alicia H. Munnell and Jean-Pierre Aubry, An Overview of the Pension/OPEB Panorama, CRR WP 2016-11 (Oct. 1, 2016).

43Invoice Reveille, “Pension funds’ rosy projections spell hassle for Illinois taxpayers,” Illinois Coverage Institute, Nov. 2, 2018.

44Adam Schuster, “Absent reform, retirement advantages will eat over half of Illinois’ taxes,“ Illinois Coverage Institute, April 24, 2019.

45“Lecturers’ Retirement System of the State of Illinois: Actuarial Valuation and Evaluation of Pension Advantages as of June 30, 2021,” 55, Segal Group, Jan. 10, 2022.

46“State Public Pension Funds Improve Use of Complicated Investments: Heavier reliance on options yields blended outcomes, highlights want for elevated transparency,” Pew Charitable Trusts, April 2017.

47Patrick Andriesen and Dylan Sharkey, “Illinois tax charges rank no. 1: Highest in U.S.,” Illinois Coverage Institute, March 15, 2022.

48Amanda Vinicky, “Pritzker’s ‘Austere’ Price range Depends on Pension Plan, New Taxes,” WTTW, Feb. 20, 2019.

49Brad Weisenstein, “Honest tax backers concede, blaming ‘deceived’ voters for loss,” Illinois Coverage Institute, Nov. 4, 2020.

50Orphe Divounguy and Bryce Hill, “With out pension reform, progressive revenue tax modification ensures tax hikes on Illinois’ center class,” Illinois Coverage Institute, Could 21, 2019.

51“Bond Scores,” Illinois State Comptroller, accessed Aug. 9, 2022, https://illinoiscomptroller.gov/financial-reports-data/data-sets-portals/bond-ratings.

52Dylan Sharkey, “$14B in in federal COVID-19 stimulus propped up Illinois’ finances,” Feb. 9, 2022.

53Schuster, “Illinois Ahead 2023.”

54Adam Schuster, “Pension reform key to defending Illinois providers, taxpayers after ‘Honest Tax’ rejection,” Illinois Coverage Institute, Nov. 12, 2020.

55Schuster, “Absent reform, retirement advantages will eat over half of Illinois’ taxes.”

56Anenson and Gershberg, The Authorized and Moral Implications of Public Pension Reform at 60.

57Id.

5840 ILCS 5/22-403.

59See Amy B. Monahan, When a Promise is Not a Promise: Chicago-Type Pensions, 64 UCLA Regulation Revue 356, 382-388 (2017).